north carolina real estate taxes

County 2020-21 Property Tax Rate. Enter an Address to Begin.

Taxes are due and payable September 1st.

. Property Tax The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the. The average property tax rate is now 6760 compared to 6785 last year a 035 decrease statewide. 4 rows Everything You Need To Know About North Carolina Property Tax Exemptions.

2021 taxes are payable without interest through January 5 2022. Department of Revenue does not send property tax bills or collect property. North Carolina Tax Assessors.

North Carolina has a flat income tax rate of. We have placed a new. North Carolina is just seven spots below Louisiana with an effective rate of 120 or about 304 dollars for a 25000 car.

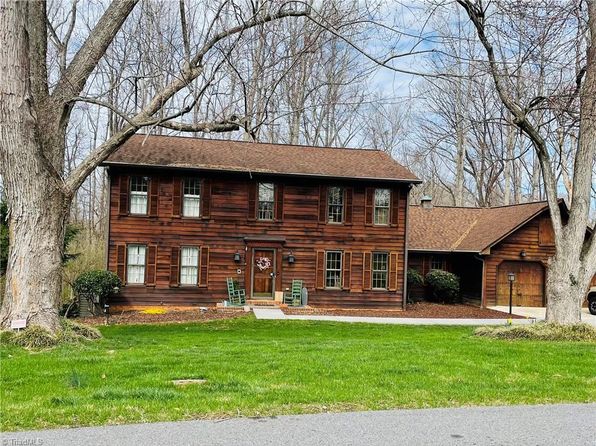

Property Taxes and Property Tax Rates Property Tax Rate. The property tax in North Carolina is a locally assessed tax collected by the counties. Counties in North Carolina collect an average of 078 of a propertys.

North Carolina Property Tax By County. Taxes must be paid on or before. North Carolina has a 475 state sales tax rate.

Pay at the Tax Collectors office on the first floor of the Union County Government Center Monday through Friday between 800 am. Ad Uncover Available Property Tax Data By Searching Any Address. What taxes do you pay in North Carolina.

Real estate and personal property listed for taxation during January are billed in July and may be paid on or before August 31 to receive a 12 discount. Ad A Full Online Property Record Search Only Takes Two Minutes. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

Tax bills do not go out and property taxes cannot be collected by the Department of Revenue. North Carolinas property tax rates are nonetheless relatively low in comparison to what exists in other states. Enter an Address in Any State to See All Associated Public Property Records.

County governments collect the local property tax in North Carolina. An interest charge of 2 is assessed on 2021 delinquent property tax. Property taxes can impact what we drive and where we.

The average effective property tax rate in North Carolina is 077 well under the national average of 107. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. Compared to other.

An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The average effective property tax rate in North Carolina is 077 which. We are responsible for listing appraising and assessing real and personal property.

The tax rate is one dollar 100 on each five hundred dollars. Some counties have their own rate that pushes it up as far as 75. Welcome to the Brunswick County Tax Office including the Tax Assessor and Tax Collector.

We Provide Homeowner Data Including Property Tax Liens Deeds More.

North Carolina State Taxes 2022 Tax Season Forbes Advisor

North Carolina Real Estate Transfer Taxes An In Depth Guide

The Ultimate Guide To South Carolina Real Estate Taxes

Property Tax Relief For Homeowners Disability Rights North Carolina

Tax Department New Hanover County North Carolina

Wake County Nc Property Tax Calculator Smartasset

How To Calculate Closing Costs On A Home Real Estate

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Gift Tax All You Need To Know Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Tax Administration Duplin County Nc Duplin County Nc

Tax Administration Duplin County Nc Duplin County Nc

North Carolina Buyer Closing Costs How Much Will You Pay

North Carolina Tax Assessors Your One Stop Portal To Assessment Parcel Tax Gis Data For North Carolina Counties